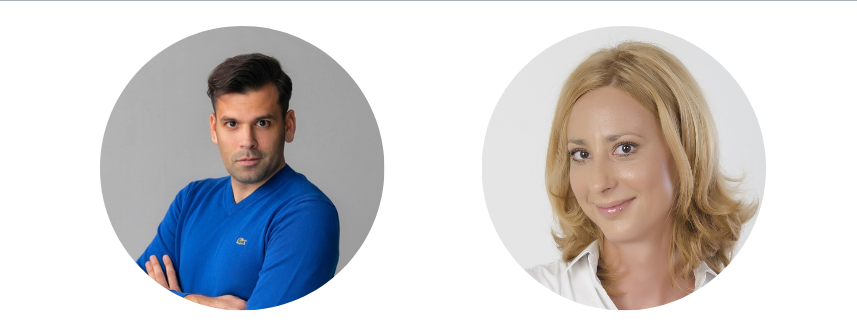

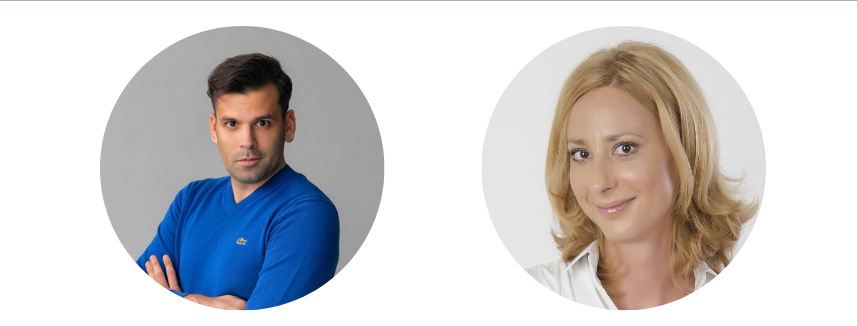

Pharmaceutical Industry Committee Chairpersons were elected at the Committee meeting on March 27. Danilo Mijušković from Merck has been elected...

Read More

Pharma Committee Chairpersons Elected

Pharmaceutical Industry Committee Chairpersons were elected at the Committee meeting…