“Global Finance“ Magazine Awarded Raiffeisen Banka the Title “Best Private Bank in Serbia“

Raiffeisen banka has received the prestigious award in the annual “World’s Best Private Banks Awards for 2022, organized by the renowned international financial magazine „Global Finance“.

The Private Banking service was introduced by the bank mid-2020, under the name „Friedrich Wilhelm Raiffeisen“ (FWR), with the idea to offer exclusive banking service to its clients in accordance with the best current global standards. In a little more than a year of business activities, FWR Private Banking achieved notable results and confirmed a leading position in its segment in the local market.

The Private Banking service was introduced by the bank mid-2020, under the name „Friedrich Wilhelm Raiffeisen“ (FWR), with the idea to offer exclusive banking service to its clients in accordance with the best current global standards. In a little more than a year of business activities, FWR Private Banking achieved notable results and confirmed a leading position in its segment in the local market.

“Awards such as this one are very important to us. All the more so, because we are receiving it for a new service introduced in the year of the pandemic, for a segment of clients with advanced banking needs, but also demanding a comprehensive and highly professional service. This award is proof that we succeeded in our basic mission – to establish long-term relationships with our clients and to make sure they are satisfied through an individual approach, using modern digital technologies. At the same time, by following the most contemporary trends in the financial market, we are making sure that our offer of products and services is unique and adjusted to the needs of sophisticated Private Banking clients“, Petar Jovanović, Deputy Chairman of the Managing Board, stated on this occasion.

This is the second award in 2021 received by the FWR Private Banking segment in contests of the best banks, organized by renowned international financial magazines. The first award „Best Bank in the Private Banking Segment“ was awarded by EMEA Finance magazine in April this year.

* * *

Raiffeisen banka a.d. Beograd is a member of Raiffeisen Bank International, one of the leading banking groups in Central and Eastern Europe. It began its business activities in Serbia in 2001, and is now developing its activities in three segments: retail banking, corporate banking, treasury and investment banking. For all additional information, please contact the Marketing & PR Department of Raiffeisen banka at the phone No. 011/2207-306.

A1 Serbia starts from you

As of April 7, Vip mobile has executed its previously announced rebranding and now appears under the A1 brand, which is strongly established in the CEE region. A1 will provide users with a unique digital experience by offering convincing services and solutions for life, work and entertainment in the digital age. This step is part of the broader strategy of the A1 Telekom Austria Group, a leader in digital services and communication solutions in the CEE region, to underpin its strong position in the European market by operating under one single brand across its footprint.

As of April 7, Vip mobile has executed its previously announced rebranding and now appears under the A1 brand, which is strongly established in the CEE region. A1 will provide users with a unique digital experience by offering convincing services and solutions for life, work and entertainment in the digital age. This step is part of the broader strategy of the A1 Telekom Austria Group, a leader in digital services and communication solutions in the CEE region, to underpin its strong position in the European market by operating under one single brand across its footprint.

As part of a large multinational Group, A1 Serbia will offer customers well-proven products and services from other markets. As of today, the mobile phones portfolio is richer for two new models – A1 Alpha 20 and A1 Aplha 20+, which are evaluated in other A1 markets through an excellent price-quality ratio. All existing and new users can enjoy a free usage of add ons of their choice every month until the end of 2021, which they can activate through the My A1 app.

The the company also announced significant improvements in network infrastructure, expansion of 4G network capacity and even greater improvement of data services. Additional infrastructural expansions are planned throughout the country, especially in the area of Belgrade and Vojvodina, which will improve the user experience to as much as 70 percent of the network.

“Digital technology offers fascinating new possibilities, enriches our daily life, but makes it more complex as well. As A1 Serbia, we will continue to be a responsible and reliable partner to our customers and offer them the best technological solutions, a strong and stable infrastructure that can support the growing data consumption, as well as advanced user experience at all levels. We want to empower people’s digital lives, enabling them to care for their loved ones, develop their business nurture businesses and make positive changes in the society they are a part of ” stated Dejan Turk, CEO of A1 Serbia and A1 Slovenia.

‘We are proud that A1 Serbia has now completed the A1 brand family – kudos to the local A1 team for the successful rebranding during such challenging times. This is a special moment for both A1 Telekom Austria Group and Serbia. As of today, we are officially operating under one consistent, powerful brand in all our seven core markets. The A1 brand is perceived as preferable and particularly trustworthy partner in unleashing the full potential of digitalization for businesses, consumers, and the public sector. With our continuous investments in digital infrastructure, we are building the foundation for future economic growth and prosperity in the region. In addition, the A1 brand is explicitly linked to our commitment to actively assume ecological and social responsibility and to be a central driver of a sustainable digital transformation in Serbia and the entire A1 Group footprint.’ said Thomas Arnoldner, CEO of A1 Telekom Austria Group.

‘Our operations in Serbia have undergone dynamic development in recent years. I´m happy that as of today, they also represent the final step in the successful execution of our Group-wide one-brand strategy journey, which we initiated in late 2017. Started in 2007 as the country’s largest greenfield investment, the company as A1 Serbia will offer an even more compelling digital customer experience by providing convincing services and solutions for life, work and entertainment in the digital age. Our common brand A1 is much more than just a logo – it covers all the crucial aspects of digitalization.’ added Alejandro Plater, COO of the A1 Telekom Austria Group.

As announced, A1 Serbia will make a big step forward in the field of integrated business solutions and digital platforms in all business segments – from smart home solutions and games to M2M, cloud and cyber security solutions for business users.

The company will continue to actively develop and launch projects dedicated to people and society as a whole, contributing to the overall development of local communities and the preservation of the environment.

Changing the name of the company in no way affects the existing contracts of users and business partners.

A1 Serbia

A1 Serbia is a member of the International Telekom Austria Group and a mobile operator which strives to improve the telecommunications market, creating the best possible user experience in the new digital era. Nearly 1,500 employees are dedicated to creating innovative solutions and services, enabling 2.4 million users to choose and make the best use of the opportunities offered by digitalization, in accordance with their needs.

A1 Telekom Austria Group is a leader in digital services and communication solutions in the region of Southeast Europe, which provides services to about 25 million users in seven countries and employs close to 18,000 people. The group is a European unit of América Móvil, one of the world’s largest telecommunications service providers.

For further information please visit www.a1.rs and www.A1.group

BELGRADE NIKOLA TESLA AIRPORT RECEIVES 2020 AIRPORT SERVICE QUALITY (ASQ) AWARDS FROM ACI

Belgrade, March 1, 2021 – Belgrade Nikola Tesla Airport – operated by VINCI Airports – has been recognized by Airports Council International (ACI) in the 2020 Airport Service Quality (ASQ) Award program as the best airport in Europe in two categories: one of the Best Airport by Size and Region (5 to 15 million passengers per year) and Best hygiene measures by Region (Europe). The Hygiene award is a new award and the airport was recognised along with several other European airports in this new category (link).

Belgrade airport is one of the seven airports from VINCI Airports network that were recognized by their customers for their exceptional experience in 2020 and were awarded by the Airport Service Quality (ASQ) program. The latest is the world’s leading airport passenger satisfaction benchmark, representing their voice worldwide, with close to 400 airports participating across 95 countries. These awards represent the highest possible accolades for airport operators and are an opportunity to celebrate the commitment of airports worldwide to continuously improve passenger experience.

”Despite the challenges posed by the pandemic, Airport Nikola Tesla has managed to collect two quartile ASQ surveys from our customers. These awards confirm our commitment to listening to our customers and maintaining quality service and safe operations especially during these trying circumstances. Improving airport and service experience will remain our focus for our passengers and all airport customers.” said Belgrade Airport CEO Francois Berisot.

Safety and passenger experience are indeed at the heart of Belgrade airport’s commitment, which benefits from VINCI Airports’ global network and expertise in keeping up to the highest international standards, as well as dedicated, hardworking and highly adaptable local teams.

As such, Belgrade Airport was recently awarded by ACI on health and environmental issues with the Airport Health Accreditation (AHA) and the first level of the Airport Carbon Accreditation (ACA). Additionally, Belgrade Airport has successfully completed the recertification process in accordance with ISO 9001: 2015 – Quality Management System and ISO 14001:2015 – Environmental Management System, and has, for the first time, been certified according to ISO 45001: 2018 – Occupational Health and Safety Management System, thus recognizing the commitment to the high level of quality services, continuous improvement of environmental protection and dedication to providing a safe and efficient working environment.

About VINCI Airports

VINCI Airports, the leading private airport operator in the world, manages 45 airports in 12 countries in Europe, Asia and the Americas. We harness our expertise as a comprehensive integrator to develop, finance, build and operate airports, while leveraging our investment capability and expertise in optimising operational performance, modernising infrastructure and driving environmental transition. VINCI Airports became the first airport operator to start rolling out an international environmental strategy, in 2016, with a view to achieving net zero emissions throughout its network by 2050.

More information:

www.vinci-airports.com

@VINCIAirports

https://www.linkedin.com/company/vinci-airports/

Bojan Mijailović – the new President of the Executive Board at Sava osiguranje

Bojan Mijailović has been appointed as the President of the Executive Board of Sava osiguranje starting from 1st January 2021.

Bojan Mijailović has been appointed as the President of the Executive Board of Sava osiguranje starting from 1st January 2021.

He has acquired vast experience in the financial sector, in management positions in insurance companies, the banking sector, as well as the National Bank of Serbia. During the previous executive term, he managed the Sava životno osiguranje that has achieved significant growth in the insurance market, improved its business operations and gained recognition due to its digital and innovative services offered to the existing and new clients.

Bojan Mijailović graduated from the Faculty of Mathematics, he is married and has three children.

Employees of Wiener Städtische insurance planted tall deciduous seedlings

The company Wiener Städtische insurance today carried out the campaign of planting 50 tall deciduous trees in Belgrade’s Ušće park and thus drew attention to the importance of strengthening environmental awareness and preserving green city areas.

The company Wiener Städtische insurance today carried out the campaign of planting 50 tall deciduous trees in Belgrade’s Ušće park and thus drew attention to the importance of strengthening environmental awareness and preserving green city areas.

Over 80 volunteers – employees of the Company, planted black ash, acacia, and Siberian elm trees in order to contribute to a healthier natural environment and the creation of a green oasis for current and future generations of Belgraders. The company is firmly committed to the well-being of the community and carries out a large part of its socially responsible activities in the field of sustainable development, ecology, and environmental protection.

“We were happy to join the traditional action of donor planting, with the desire to contribute to the increase of the green fund and the better appearance of our city. I thank Zelenilo-Belgrade for the cooperation during the implementation of the action, which, I believe, will contribute to raising awareness of the importance of caring for green areas and the culture of living in our city,” said Svetlana Smiljanić, member of the Executive Board of Wiener Städtische insurance.

This is the first eco-action of the Wiener Städtische insurance this year, whose volunteers last year conducted as many as 15 actions throughout Serbia, showing their commitment to environmental protection. To be a good partner and friend of the community in which it operates, the company has been implementing the employee volunteering program – Chain of Kindness for 13 years, and together with partners in numerous areas, it affects the improvement of citizens’ living conditions, implements environmental actions and helps socially sensitive population groups.

This is the first eco-action of the Wiener Städtische insurance this year, whose volunteers last year conducted as many as 15 actions throughout Serbia, showing their commitment to environmental protection. To be a good partner and friend of the community in which it operates, the company has been implementing the employee volunteering program – Chain of Kindness for 13 years, and together with partners in numerous areas, it affects the improvement of citizens’ living conditions, implements environmental actions and helps socially sensitive population groups.

Euromoney: Raiffeisen Best Bank for Digital Solutions in Serbia

The renowned global financial magazine “Euromoney“ awarded Raiffeisen the title “The Best Bank for Digital Solutions in Serbia“ in 2023. The title is awarded as part of Euromoney’s “Awards of Excellence“ programme, which identifies the best banks that have set themselves apart by a range of key banking activities in the preceding year.

Zoran Petrović, Chairman of the Managing Board of Raiffeisen banka, stated that he was proud of each award, but that each one also signified an additional level of responsibility.

“This is especially true for international awards for digital and innovative solutions“, Zoran Petrović stated.

To be the first, he stressed, also means the obligation to raise the standards constantly.

“Digitalization is not a goal in itself, but the intersection of creativity, innovation and our clients’ needs. Technology is an extraordinary instrument which enables us to simplify processes and make life easier for our users. Being a pioneer means working incessantly on improving services and providing a superior user experience, but also investing into the most contemporary banking solutions“, Petrović pointed out.

The title is awarded as part of Euromoney’s “Awards for Excellence“ programme, which identifies the best banks that have set themselves apart by a range of key banking activities in the past twelve months.

“Euromoney“ is one of the leading monthlies focusing on banking, finance and capital markets. It was established in 1969 and with its “Awards for Excellence“, which started back in 1992, this magazine has been awarding financial institutions which have realized the best business results in their markets, as well as the leading banks in more than 100 countries.

Beginning August, the global financial magazine “Global Finance“ awarded Raiffeisen banka the title “The Best Digital Consumer Bank in Serbia for 2023“.

This year for the first time, Raiffeisen banka has also been awarded two titles in sub-categories of this contest – “The Best Consumer User Experience (UX) Design in Serbia“, as well as “The Best Consumer Mobile Banking App in Serbia“.

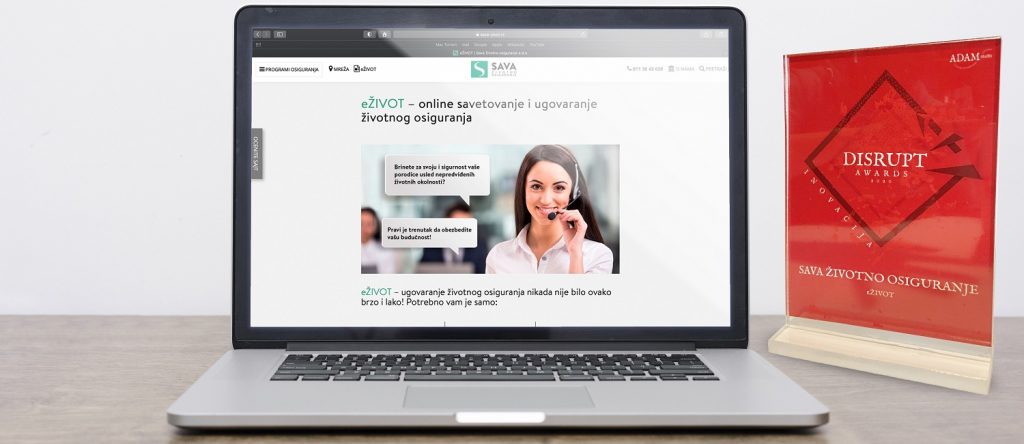

eŽIVOT declared best Disrupt project in Financial Sector category, Innovation subcategory

The Disrupt contest prizes were awarded online for the best projects that marked the year 2020.

Sava životno osiguranje was declared as the winner in the Financial Sector category, Innovation subcategory, for the eŽIVOT (eLIFE) project.

Sava životno osiguranje is the first insurer on the Serbian market to supplement the traditional life insurance contracting with the online life insurance contracting service with own video identification – eŽIVOT. Using this new service is very simple. After the client’s conversation with the life insurance advisor, the client receives an offer by e-mail, created in accordance with his/her needs and an SMS code for secure access and advanced electronic signing of documents. In the eŽIVOT process, this is followed by video identification which is intended to verify and confirm the identity of the insured during online life insurance contracting.

The Disrupt contest gathered 60 top-quality works from companies, agencies and associations which excelled in the field of Disrupt Innovation or Disrupt Communication and, during an extremely difficult 2020, managed to succeed through their activities and contribute to social progress. The awards ceremony was organized on April 1 in an online format.

The following were awarded in the Disrupt Innovation category: Donesi for the Uvek u pravom trenutku project, Coca Cola HBC Srbija for HoReCa zajednica, Lasaffre for ePekar, Preventer for Klub književnika, Delta Motors for MINIxŠkrabac, Galenika and Chapter4 for Zdravo dvadesete, Direct Media for Direct Neuro, Sava životno osiguranje for eŽivot, Banca Intesa for It’s time for sharing time, Mokrogorska škola menadžmenta for MEMBA 2.0, VIP mobile and Executive Group for VIP virtuelna prodavnica.

The following were awarded in the Disrupt Communication category: Mercator-S for the IDEA karavan project, Atlantic Grand and Luna TBWA for Hajde da imamo vremena, SuperDot for Wine trekkers, Galerija Matice srpske for Izvanredno u vanrednom, Propulsion i AstraZeneca for Pokret Kiseonik, Hemofarm for Sa nama život pobeđuje, M2Communications and NVO Astra for Paralelna stvarnost – surova realnost, Balkan Tube Space for Balkan Top Star, Banca Intesa for Čajanka četvrtkom u 17h, New Moment New Ideas and Visa for She’s next, GourmAna for Druženje sa GourmAnom, Levi 9 for Interne komunikacije.

Special prizes – Disrupt Brutal were awarded to Koncern Bambi for the Plazma rituali project, Disrupt Influence was awarded to Atlantic Grand and Popular Communications for InstaGrand #SamoUživaj, while Disrupt Star was awarded to Mercator-S for IDEA karavan.

An expert jury composed of top professionals from various fields decided on the winners.

“The Disrupt contest involved 60 works of companies which in 2020 managed to recognize the chance for improvement and implement projects that were Disrupt in terms of innovation or communication. All winners absolutely deserve their titles”, said Mila Zavođa, director of the ADAM studio agency, which organizes this contest.

On the occasion of the 200th anniversary of the Wiener Städtische Versicherungsverein, an exhibition entitled as “Unknown Familiars” was opened on May 7th at the prestigious Leopold Museum in Vienna, featuring certain parts from the art collections of Vienna Insurance Group (VIG) and Wiener Städtische Versicherungsverein. With fifty insurance companies in thirty countries, this leading insurance group in Central and Eastern Europe has a total of six corporate art collections that are coming together for the first time in this exhibition with their different focal points and history of development. In this respect, they are unknown familiars – related, but who have never met before.

On the occasion of the 200th anniversary of the Wiener Städtische Versicherungsverein, an exhibition entitled as “Unknown Familiars” was opened on May 7th at the prestigious Leopold Museum in Vienna, featuring certain parts from the art collections of Vienna Insurance Group (VIG) and Wiener Städtische Versicherungsverein. With fifty insurance companies in thirty countries, this leading insurance group in Central and Eastern Europe has a total of six corporate art collections that are coming together for the first time in this exhibition with their different focal points and history of development. In this respect, they are unknown familiars – related, but who have never met before.

FIC members, potential members and partners enjoyed the opportunity to meet at the0 FIC cocktail on 20th September. Cocktail hosted by member A1 was held on the roof of A1 premises at Novi Beograd, under the motto “From Summer Glow to Business Flow – Autumn Cheers”. Members were greeted by the FIC Executive Direktor Aleksandar Ljubic and A1 Serbia and Slovenia CEO Dejan Turk. The FIC Executive Director said that until the end of the year there will be a number of occasions for FIC members to meet and work together on the improvement of business climate in Serbia. He mentioned in particular the Conference on Regenerative Agriculture which was to be held the week after the cocktail, and the White Book Launch scheduled for November. He thanked member A1 and Dejan Turk for hosting the cocktail.

FIC members, potential members and partners enjoyed the opportunity to meet at the0 FIC cocktail on 20th September. Cocktail hosted by member A1 was held on the roof of A1 premises at Novi Beograd, under the motto “From Summer Glow to Business Flow – Autumn Cheers”. Members were greeted by the FIC Executive Direktor Aleksandar Ljubic and A1 Serbia and Slovenia CEO Dejan Turk. The FIC Executive Director said that until the end of the year there will be a number of occasions for FIC members to meet and work together on the improvement of business climate in Serbia. He mentioned in particular the Conference on Regenerative Agriculture which was to be held the week after the cocktail, and the White Book Launch scheduled for November. He thanked member A1 and Dejan Turk for hosting the cocktail.